Disclosure: I have no positions in any stocks mentioned, but may initiate a short position in BREUF.PK, HMCBF.PK, RONAF.PK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Since the year 2000, approximately, Canada's real estate market has been one of the best performing asset classes on the planet. The average price across the country has risen from approximately $150,000 in 2000 to over $350,000 today, a compounded return in excess of 7%. To put that in perspective, the compounded return on housing between 1980 and 2000 was a mere 4.7%, and that includes years of considerably higher inflation.

The epicenter of this bubble is in the Vancouver and Toronto markets. Both markets have experienced massive growth, fueled primarily by low interest rates and loose mortgage rules. The average house in Vancouver will set you back $1M, or a mere 15x the median family income of $67.5k. The ratio isn't as extreme in Toronto, but the average house will set you back $600k, a mere 9x the median family income.

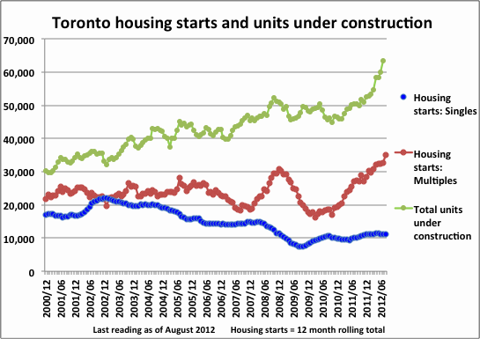

As real estate has become more unaffordable in Canada's two largest cities, consumers have responded by moving into more affordable units, primarily condos and houses further and further into the suburbs.

Builders have responded to the condo shift by building more units. Check out Toronto's housing starts, focusing on the multiple unit part of the chart (click to enlarge image):

(Source)

There are all sorts of reasons why the Canadian real estate market seems poised to fall off a cliff. Go check out many of the excellent articles here at Seeking Alpha for a more detailed look. Instead, I want to focus on 3 ways you can profit from the falling market.

1. Brookfield Real Estate Services (BREUF.PK)

This is the parent company of Royal Lepage, Canada's third largest real estate brokerage, which holds approximately a 22% national market share.

As the market slows, so will the number of transactions. If you combine that with a decrease in house prices, it becomes a bad time to sell houses for a living. During the American housing bust, the number of realtors decreased almost 30%.

The majority of the company's revenues come from fixed monthly fees paid by realtors. If we assume a similar attrition rate to the American market, we automatically see a 30% decrease in revenues of this segment of the business.

The company also collects variable fees from agents, based on a percentage of earnings. American transactions fell 50% from peak to trough. We can also expect significant weakness in this source of revenue.

Most of the company's offices across the country are franchises, except for several located in downtown Toronto. Fees collected from these agents represent approximately 20% of the company's total revenues, and could easily fall 50% if the Toronto market implodes.

The company is also sitting on some significant debt, the majority of it is variable in nature. Not only is the company's product harmed with an increase in interest rate, so is the company's debt. An increase in debt servicing costs plus a decrease in revenue could easily trigger debt covenants.

There's just one problem with shorting this name - it pays a 9% dividend, paid out monthly. This dividend will become unsustainable once it becomes obvious the market is suffering, but nobody really knows when that will happen.

2. Home Capital Group (HMCBF.PK)

Home Capital is Canada's largest alternative lender, holding over $16B in loans for non-traditional borrowers.

The company has experienced impressive growth over the last few years, as demand for all types of mortgages have increased. Home Capital's borrowers generally pay interest rates twice that of better qualified borrowers, but low interest rates have made these inflated rates considerably more affordable.

According to their last annual report, approximately 55% of their loan portfolio is guaranteed by Canada's national mortgage insurer, CMHC. They're also heavily concentrated in Ontario, with 75% of their loans coming from that province.

Home Capital also has significant more risk than one of Canada's big banks because the banks have diversified a significant portion of their revenue to areas outside of Canada.

Therefore, Home Capital becomes the de facto way to play any downturn in the Canadian market. Fundamentals, for the most part, won't matter. Home Capital is perceived as a risky lender, therefore it will go down as investors look to rid themselves of any exposure to the real estate market.

Back in 2008, when the Canadian market was beginning to suffer just like the American one (it later recovered and rose to the unprecedented heights we see now) Home Capital lost over 50% of their value in just a few months.

Home Capital also pays a dividend, but it is a much more manageable 1.7%. Unlike the first option, it does have options that are active, meaning you can play it without actually shorting the stock.

3. Rona (RONAF.PK)

Unfortunately, I can't find a publicly traded Toronto condo builder. Unlike the American market, which has several large, publicly traded home builders, Canada has no such proxy on the builder market. So we'll have to look at the next best thing, building supplies.

Rona is a Quebec based chain, basically the Canadian version of Home Depot. They're primarily based in eastern Canada, but their presence has expanded to western Canada over the past decade, thanks to some strategic acquistions.

Lowe's (LOW) was recently attracted to Rona, submitting a $14.50 offer to buy the company. Thanks to company opposition and pressure from the Quebec government, Lowe's eventually withdrew their offer.

This is good news for investors who want to bet against Canadian housing. As values and sentiment go down, so does the amount of spending on the asset class. No longer is a renovation considered a source of easy profit.

Plus, as values go down, so does equity that can be withdrawn to fund a renovation. Even if somebody wants a new kitchen, they'll quickly lose the ability to borrow against their house to pay for it.

The company pays a 1.3% dividend, a small obstacle to an investor looking to short the company. Or, if you're so inclined, you can use options to play the name.

Source: http://seekingalpha.com/article/977221-3-ways-to-short-the-canadian-real-estate-market

Green Coffee Bean Extract the voice september 11 adam levine 9/11 Memorial jessica simpson chris brown

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.